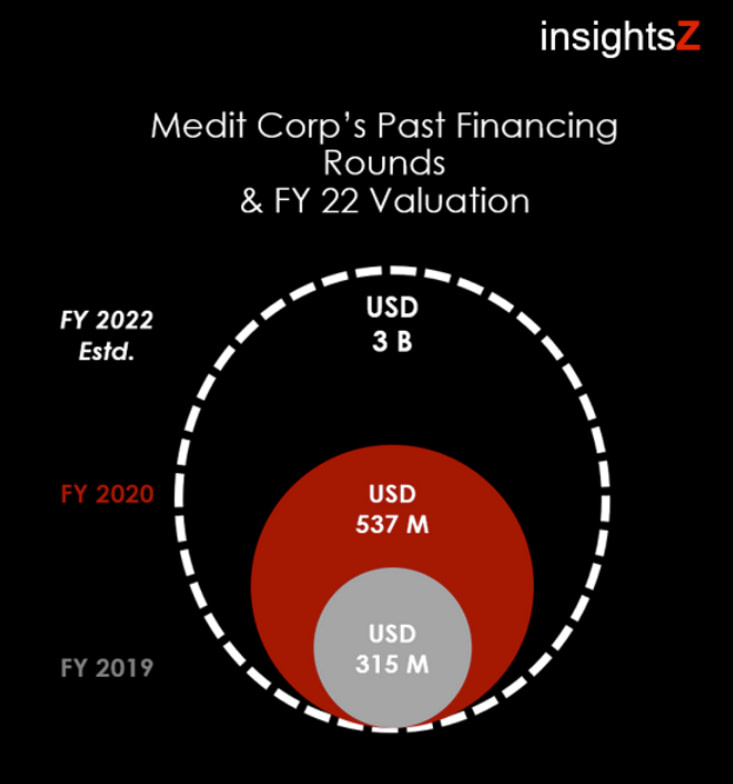

After bursting onto the scene with their first IOS device just under 5 years ago, digital dentistry juggernaut Medit, has been listed for sale at a whopping 4 trillion won (3.1 billion USD).

Japan based Private Equity group and major shareholder, Unison Capital, is said to have sent teaser letters to prospective buyers to purchase Medit Corp, according to the Korea Economic Daily. Unison Capital owns 51 percent of the company whereas the remaining is still held by the company’s original founder, based on insightsZ sources.

Medit has attracted a flurry of interest, from both global private equity powerhouses and Korean companies looking to get a slice of the intraoral scanning market. As far as attractive investment opportunities are concerned, you can’t do a lot better than Medit at the moment.

Why is Medit such an attractive investment?

Medit has grown exponentially in value since Unisons initial investment in 2019, and is now one of the world’s top two intraoral scanner companies in terms of market share.

Additionally, Medit’s earnings before interest, taxes, depreciation and amortization (EBITDA) have nearly tripled to over 103 billion won (~78 million USD) from 36.7 billion won in 2019. Sales have also skyrocketed, doubling to 190.6 billion won (~144 million USD) last year from 72.2 billion during the previous period.

It looks like Medit’s profits are set to increase further, expectations for this year are 300 billion won and EBITDA 200 billion won.

The company handling the sale, Citigroup Global Markets, is planning on opening a limited auction for a small number of buyers, with bidding to start in August and a goal to complete the sale in October of this year.

I have personally reviewed all their scanners and as many of you who are familiar with my content may know, they are some of the best scanners on the market. You can read the reviews here.

What are some of the downsides?

According to insightsZ "while the acquisition premium is based on the new buyer’s synergy potential, nevertheless it will be difficult to find a buyer with that price tag exceeding USD 3 billion". Some of the reasons include:

- Medit Corp. has not yet figured out how to transform itself from an equipment manufacturer to a software as a service (SaaS) company. In other words, while dentists have been enjoying no subscriptions for the longest time, it doesn't actually make business sense. Medit has launched its software suite of Medit Apps, but has not yet offered a paid-subscription model (or at least a one that’s commercially successful). For this reason, it is not valued as a software company, but rather as a medical device equipment manufacturer according to insightsZ.

- Global inflationary pressure is negatively impacting consumer demand and margins alike. This has clear impacts on the company’s expected sales projection, especially as the outlook for the remaining FY 2022 still looks uncertain.

- Medit’s portfolio of intraoral scanners achieves the same level of efficacy as other leading intraoral scanner brands, but at a significant price discount. This has its own negative impact on the brand’s margins versus other leading premium IO scanner brands like Primescan and iTero.

What does this mean for Medit users?

Although it’s difficult to speculate at this early stage, it doesn’t look like the sale of Medit would mean a monumental shift in their overarching business strategy. That would be really silly for any company to do that.

As seen in the incredible growth above, Medit is very well run. This isn’t a case of a buyer coming in to change the company and improve revenue massively. This could just be a case of the intraoral scanning market being too attractive of investment to pass up.

Intraoral scanning companies are seen as extremely interesting investments, due to the fast growth of the market and the expectations of huge growth to come.

If I was to play the devils advocate however, in the future it could mean that a lot of the freebies we have been provided by Medit start to change. Currently the scanner itself has no subscription costs and only a comical 0.99 USD per month storage cost for those that want to use the cloud.

I can't imagine any company would be silly enough to add subscription fees to the Medit scanners, but is it sustainable to provide all the software for free? Or is this just a very good tactic by Medit to capture as much market share as possible and then sell it off and make that someone else's problem. Time will tell. It is all just speculation.

The news of Medit’s sale comes after Envista recently entered into a definitive agreement to acquire Carestream Dental for $600 million (USD) in April.

Medit's reputation over the years

Medit’s stature over the years has not only grown financially, they’re also considered a very reputable option for dentists looking to implement digital dentistry into their clinics.

The i500 was a game changer when it first launched, and recent entries into Medit’s portfolio such as the i600 and i700 Wireless have shown that the company is not afraid to innovate and take risks.

Who will buy it?

In short no one knows.

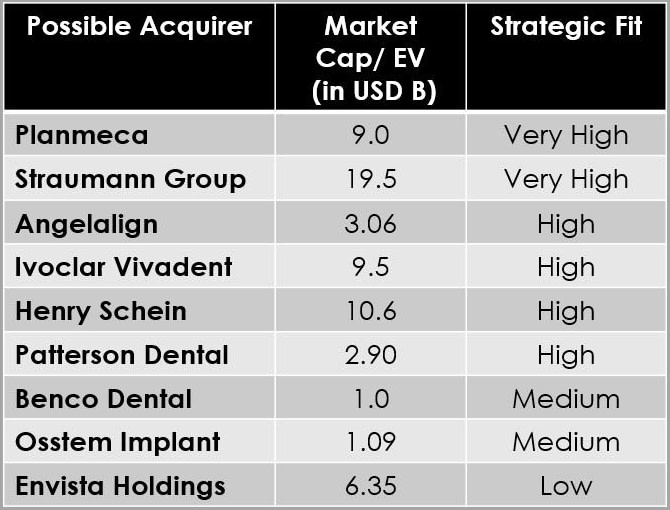

Anything at this stage is pure speculation but there are some companies that it would make a lot of sense for. Again, the team at insightsZ have shared some insight summarized in the image below which may be of interest to some:

The intraoral scanning market is set to explode

Currently, intraoral scanning companies are seen as having incredibly high growth potential and a risk worth taking. The global intraoral scanners market reached a value of US$ 354.6 Million in 2021. Looking forward, IMARC Group predicts the market to reach a value of US$ 581.8 Million by 2027 exhibiting a CAGR of 8.10% during 2022-2027.

An excellent paper which ever i read with very dedicated interesting data of amazing Medit

Thanks! I am glad you found it useful.