The MENA dental industry's crown jewel, AEEDC Dubai, has once again exceeded expectations with its 2025 edition, cementing its position as the largest annual dental conference and exhibition globally.

The sheer scale of this year's event is staggering with exhibition space expanding by 30% compared to last year, hosting over 4,800 brands from 3,000+ companies spanning 89 countries. The Middle East's position as a dental hub continues to strengthen, with Dubai serving as the perfect crossroads between East and West. This year's attendance figures speak volumes - over 66,000 visitors from 155 countries, a testament to the region's growing influence in the global dental industry.

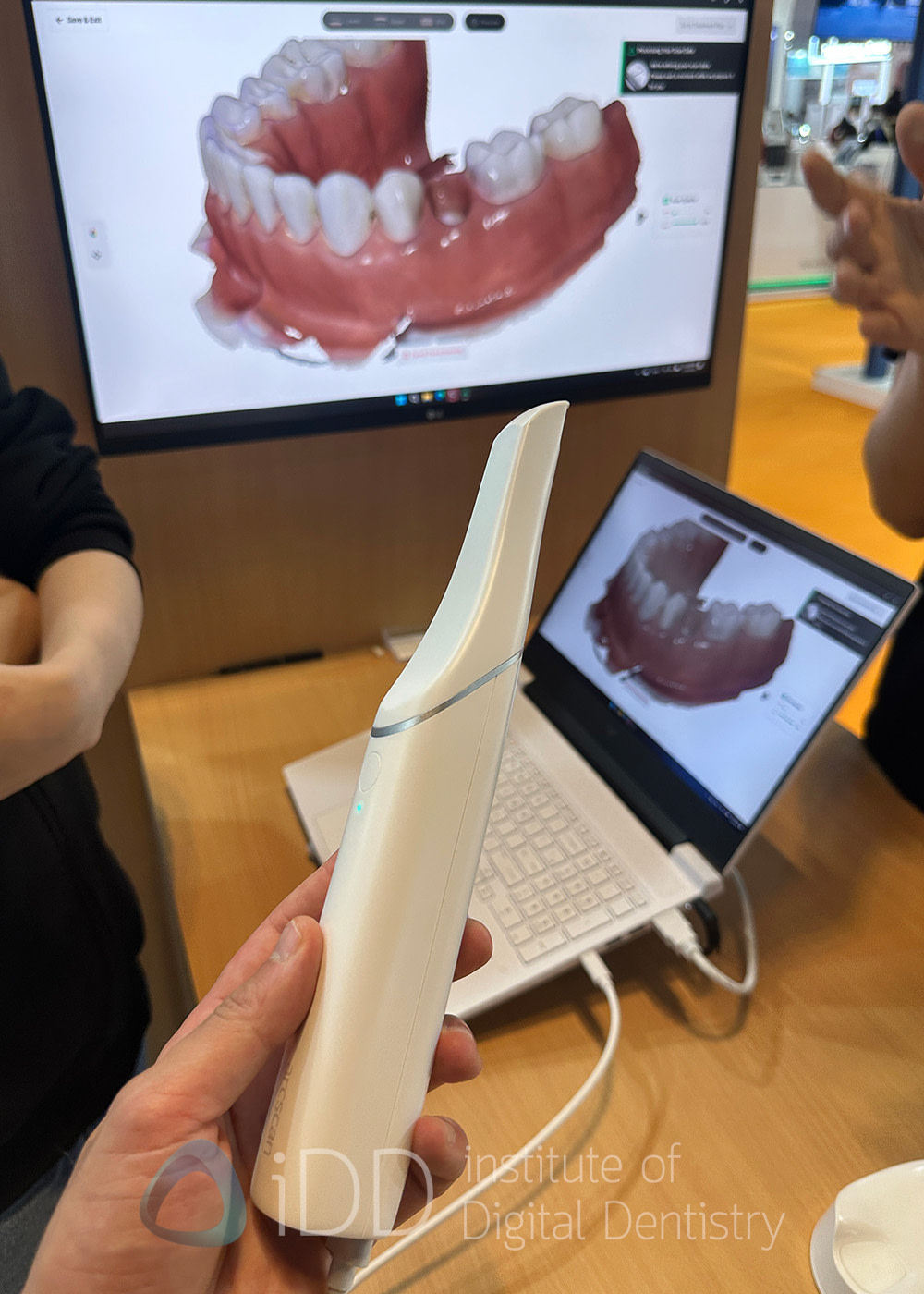

What sets this year apart is the unprecedented rise of digital dentistry. Walking through the sprawling halls of the Dubai World Trade Centre, it's impossible to miss the transformation. Many booths showcasing intraoral scanners, 3D printers, or CAD/CAM systems. The digital workflow is no longer the future; it's very much the present, with even traditionally analog-focused companies pivoting hard toward digital solutions.

I am grateful for the opportunity to present at the event. I gave five lectures in-booth at the exhibition halls and also in one of the main lecture halls. Thank you AEEDC for the opportunity to contribute to the future of dentistry!

AEEDC 2025 also marks a significant shift in industry dynamics. The exhibition floor reveals an interesting trend - traditional boundaries between different dental sectors are blurring. Companies known for their expertise in one area are expanding into others, creating comprehensive digital ecosystems rather than standalone products. The integration of AI and machine learning in dental workflows is no longer a novelty but a growing trend, with practical applications ranging from diagnostic assistance to treatment planning and practice management.

Let's take a deep dive all the companies and innovations that caught my attention at this year's AEEDC Dubai.

Don't have time to read the full overview? Get the PDF

Key Industry Trends at AEEDC 2025

Scanner Market Transformation

The proliferation of intraoral scanners, particularly from Chinese manufacturers, was evident throughout the show. Both sold as unique products and the large number of white-labeled products. This trend has contributed to dramatically lower price points, with some intraoral scanners now available for as little as 2-3K USD. The democratization of scanning technology continues to accelerate, though software capabilities increasingly become the key differentiator.

In every market, products naturally segment into three categories: budget, mid-range, and premium. This pattern holds true whether you’re looking at cars, electronics, or even dental technology - including intraoral scanners. It is important to realise that at the budget end, we see entry-level scanners that prioritize affordability over high-end features.

These scanners in my experience and testing often have limitations in software capabilities and accuracy (expecially in complex cases like full-arch implant scans), but provide a cost-effective solution for practices looking to step into digital dentistry without a significant upfront investment.

Full-Arch Implant Solutions Dominate

The emphasis on full-arch digital workflows was unmistakable, with many major IOS companies either showcasing or developing solutions in this space. This focus reflects growing market demand for simplified and accurate full-arch implant scanning.

One of the most notable trends this year was the surge in horizonal scan body and photogrammetry solutions. Following the success of Shining 3D's Elite scanner, every scanner company seems to be rushing to have their own full-arch solution. The Elite made waves.

Scanning technology is clearly moving beyond traditional photogrammetry methods, with innovative approaches ranging from iPad-based systems to dedicated scan body units. In saying that we also saw a new photogrammetry unit by a Chinese company be teased, which will likely drive the price further down.

The Rise of Face Scanners

Facial scanning technology also seems to be a trend, with three new face scanners from Chinese manufacturers debuting at this event alone. While still somewhat niche, facial scanning appears to be popular, driven by the increasing demand for improved treatment planning and case execution. Alongside dedicated hardware from new entrants, phone-based solutions like iPhone apps are expanding accessibility. As more products enter the market, it will be interesting to see how established players like Ray respond to this growing segment.

Manufacturing Evolution

The exhibition floor revealed several key manufacturing trends:

- 3D printing solutions continued to multiply, with offerings ranging from chairside units to high-throughput manufacturing systems.

- Resin manufacturers expanded their portfolios, particularly in the permanent restorative space.

- Zirconia manufacturers maintained strong presence, with some expanding into digital equipment.

- New glazes and characterisation solutions for printable materials showing the maturing of 3D printing for final restorations.

Lets go over what we saw from each company in alphabetical order

Aidite - From Materials to Digital Ecosystem

Aidite, one of the largest zirconia manufacturers globally, demonstrated their expanding digital portfolio at AEEDC 2025. While their reputation is built on materials, particularly their extensive zirconia line, their booth showcased a growing ecosystem of digital solutions including intraoral scanners and their new 3D printer.

Notably, Aidite appears to be transitioning away from their previous Shining 3D OEM scanner arrangement, with their booth featuring a Runyes OEM scanner instead. This switch in scanning technology partners raises interesting questions about their strategic direction in the digital space.

This expansion from materials into scanning and printing technology signals Aidite's ambition to become a complete solution provider. As a dominant player in the zirconia market, their move to offer comprehensive digital workflows - from scanning through to manufacturing - represents another major materials company evolving to meet the changing demands of modern dentistry.

Their transformation from a materials-focused company to a provider of complete digital solutions, along with their evolving OEM partnerships, will be interesting to watch as they continue to define their position in the digital dental space.

Alliedstar - Rebranded for the Future

Alliedstar made a big impression at AEEDC 2025 with a completely reimagined presence. The company's rebranding effort, featuring a new logo and visual identity, was reflected in their dramatically upgraded booth design – a testament to their evolution and growing ambitions in the digital dentistry space (especially after the Straumann acquisition). This booth was a huge upgrade from last year.

Their scanner lineup, headlined by the AS 260 and the wireless AS200E, and the constant lectures happening at their booth drew consistent crowds throughout the event. The hands-on demonstrations highlighted how far Alliedstar has come in refining their scanning technology and user experience. The original AS100 was always a fast scanner (I reviewed it 3 years ago) but now with their new software, this is a much more complete solution. Additionally, the AS200E particularly resonated with practitioners looking for more affordable wireless scanner.

I had the privilege of speaking at their booth, where the energy and enthusiasm from both the Alliedstar team and visiting clinicians was palpable. The company has clearly positioned itself as a serious competitor in the intraoral scanning market, with their technology matching their renewed brand promise. Their commitment to the region was evident in both their significant booth investment and their enhanced support infrastructure for MENA customers.

Don't have time to read the full overview? Get the PDF

Amann Girrbach - Austrian Milling

Amann Girrbach's presence at AEEDC 2025 showcased their range of milling systems, with no new hardware announcements this year. Their industrial-grade machines, known for handling everything from implant components to full-contour zirconia restorations, continue to meet the demands of production facilities. The company's established reputation in the high-end milling market remains strong, particularly among larger laboratories requiring reliable, high-throughput solutions.

Arcreal - Poised for a New IOS Launch

One year after showcasing their initial prototype, arcreal returned to AEEDC 2025 with a significantly matured product. Their arcscan intraoral scanner appears much closer to market readiness, and what stands out most is its exceptional user interface and experience design.

While the scanner currently focuses on scan-and-send functionality without additional apps, the UI/UX implementation is among the most polished I've seen in any scanner on the market. This attention to user experience extends to their cloud-based management software, suggesting arcreal has spent their development time thoughtfully rather than rushing to market.

Their focused approach of perfecting core scanning functionality and user experience before expanding into additional applications, is refreshing in a market where feature lists often overshadow usability. It will be interesting to see how the arcscan performs in the crowded intraoral scanner market, particularly given the emphasis they've placed on user experience.

Asiga - Showcase Ultra and Max 2

Asiga's booth focused on showcasing their latest printer lineup, with the Ultra and MAX 2 taking center stage. The Ultra, with its high throughput capabilities and DLP technology, continues to gain traction in the dental lab space. Meanwhile, the MAX 2 demonstrates the company's commitment to precision manufacturing in a small printer, with its proven track record in dental applications from surgical guides to models.

While no new product announcements were made at this year's AEEDC, there's anticipation in the industry about potential developments from Asiga, particularly given their history of innovative releases. The company's dedication to open materials and continued software refinements shows their focus on enhancing their existing ecosystem.

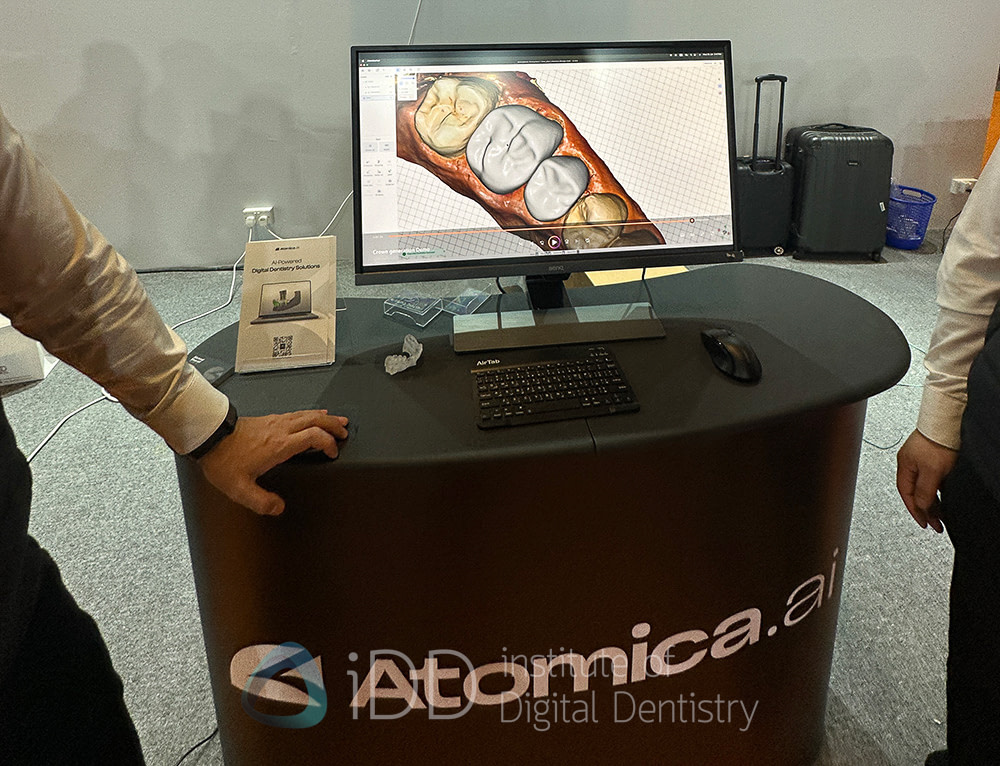

Atomica.AI - Expanding Cloud CAD Horizons

Atomica.AI's booth at AEEDC 2025 showcased their evolving cloud-based portfolio. The company, which initially made waves with their innovative cloud-based stackable surgical guide design solution, is now broadening their scope into restorative dentistry.

Their stackable guide technology remains impressive - automating what has traditionally been a complex and time-consuming design process. However, their expansion into cloud-based crown and restoration design signals their ambition to become a more complete CAD solution provider. This move puts them in direct competition with established players like 3Shape Automate and Dentbird in the increasingly competitive cloud CAD space.

This expansion is particularly interesting as it represents another step in the industry's shift toward cloud-based design solutions. With multiple companies now offering AI-driven, cloud-based design services, the competition to provide the most efficient, accurate, and user-friendly solution is intensifying. Atomica.AI's proven success with surgical guides could give them a unique advantage as they venture into this broader market.

BEGO - Material Innovation in 3D Printing

BEGO's presence at AEEDC 2025 centered around their TriniQ resins. Known for their long history in dental materials and equipment, their booth focused heavily on demonstrating the capabilities of their advanced printing materials. The Triniq resin, in particular, showcases their commitment to developing materials that meet the increasing demands of digital dentistry.

As 3D printing continues to gain acceptance for direct restorations and temporary solutions, the importance of high-performance resins becomes increasingly critical. BEGO's strategic focus on materials development, rather than expanding into hardware offerings, positions them well in this growing segment of the market. Their emphasis on material science and printing reliability reflects an understanding that as 3D printing becomes more mainstream in dentistry, the quality and predictability of materials become key differentiators.

Their approach stands in interesting contrast to other companies at AEEDC who are expanding into hardware, suggesting there's still significant value in focusing on material expertise in the evolving digital dental landscape.

Don't have time to read the full overview? Get the PDF

COXO - Expanding Beyond Endo

COXO, well-known in the MENA region for their endodontic products, displayed their OEM version of the Launca scanner at AEEDC 2025. This move into digital scanning represents an interesting diversification for a company traditionally focused on endo equipment.

The Launca-based scanner offers a solid low-cost entry point into digital dentistry. Notably, Launca's technology has evolved significantly, with their software showing marked improvements over their original platform. These advancements in both scanning capabilities and software interface demonstrate how rapidly scanner technology continues to mature, even in the more affordable segment of the market.

This partnership between COXO and Launca illustrates a growing trend of established dental companies leveraging OEM relationships to enter the digital space, particularly in regions where price sensitivity plays a crucial role in technology adoption.

DentBird - Cloud CAD Evolution

DentBird's presence at AEEDC 2025 highlighted how far their cloud-based CAD solution has come. Their platform now stands as one of the more mature offerings in the cloud CAD space, notably being one of the few solutions capable of handling bridge designs alongside single-unit restorations.

The sophistication of their software demonstrates significant development since their initial launch, with expanded capabilities and refined workflows. Particularly noteworthy is their upcoming transition to a subscription-based model, marking a shift in their business strategy and potentially making their solution more accessible to a broader range of practices.

As cloud-based design solutions continue to gain traction in digital dentistry, DentBird's evolving platform and business model could position them well in an increasingly competitive space where automated design solutions are becoming the norm rather than the exception.

DG Shape - Steady in the Milling Space

DG Shape's booth at AEEDC 2025 focused on their established line of milling machines. The company, known for their reliable dental milling solutions, maintained their market presence without introducing new hardware this year at AEEDC.

Their range of mills, from compact desktop units to more robust lab systems, continues to serve different segments of the market - from clinics requiring basic crown and bridge milling to labs needing more sophisticated applications. The DWX series, in particular, remains a staple in many dental laboratories.

As the industry discusses the growing role of 3D printing in dental manufacturing, DG Shape's continued focus on milling technology underscores that subtractive manufacturing still holds a crucial place in digital dentistry, particularly for high-precision restorative work and certain materials that still require milling rather than printing.

Eighteeth - Established in Endo, Growing in Digital

Eighteeth demonstrated their strong regional presence at AEEDC 2025, with their low-cost endodontic product line continuing to do well in the MENA market. Their booth highlighted their comprehensive endo solutions.

On the digital front, the company displayed their Helios scanner lineup, including the entry-level Helios 500, 680 and new 700. The new Helios 700 is the same as the 680, but wireless. All these scanners are very much in the entry-level segment for those who want an IOS with minimal investment possible.

Notably, the Helios 600, which was a rebranded Allied Star scanner, is phased out, particularly in light of Straumann's acquisition of Allied Star. This transition in their scanner portfolio reflects the broader industry consolidation and strategic shifts happening in the digital dentistry space.

The Helios 500 continues to be one of the most affordable scanners in the region.

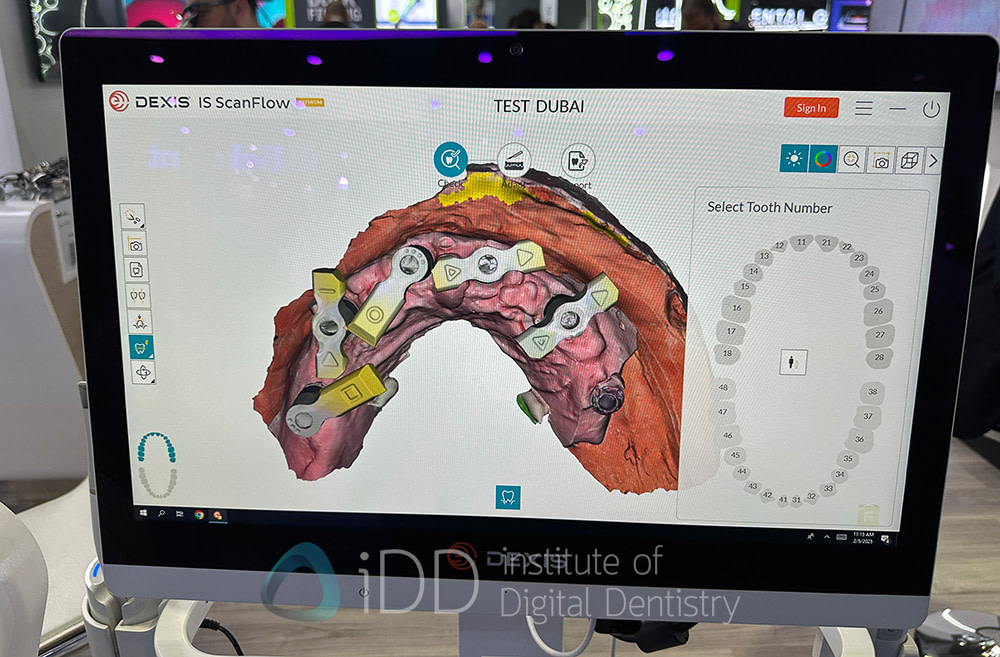

Envista - Refining Their Digital Portfolio

Envista's booth at AEEDC 2025 showcased their range of digital solutions, spanning CBCT systems and intraoral scanners. While their core hardware lineup remained unchanged, including their DEXIS IO scanner, they introduced a new scanner cart design and highlighted their developing full-arch scanning solutions.

This focus on full-arch workflows follows a clear industry trend, as manufacturers work to simplify what has traditionally been one of digital dentistry's more challenging applications. Rather than launching new hardware, Envista appears to be concentrating on optimizing their existing platforms through software improvements - a strategy we're seeing from several major manufacturers at this year's event.

I will be interested to see if they release any new hardware at IDS.

Fussen - Making Digital Dentistry Accessible

Fussen's large booth at AEEDC 2025 highlighted their transformation into a comprehensive digital imaging provider. Their expanding portfolio now includes intraoral scanners, CBCT units, and a new face scanner, reflecting a strategic shift from being a scanner manufacturer to offering complete digital imaging solutions.

Their intraoral scanner's pricing at 2-3K USD is particularly significant, representing the dramatic evolution of the scanner market. This price point would have been unthinkable just a few years ago when entry-level scanners started at 15-20K USD. While premium scanners still maintain their place in the market, Fussen's affordable option exemplifies how the barriers to entry for digital dentistry continue to lower. I will say what you pay for is what you get.

Their move into CBCT and face scanning technology suggests Fussen is positioning themselves as a serious player in the digital imaging space, aiming to provide comprehensive solutions for practices at more accessible price points. This expansion of their portfolio, combined with aggressive pricing strategies, makes them an interesting company to watch, particularly in regions where cost-effective digital solutions are in high demand.

Graphy - Direct Print Aligners

Graphy also made a showing at AEEDC 2025. The company's specialized aligner resins, which can be printed directly without the need for thermoforming, continues to draw significant attention from clinicians and labs alike. I will say I am hearing mixed feedback from those who have actually used their aligner resins and I am curious to see how they develop. Personally, I still thermoform aligners for many reasons.

At their booth they also had newly OEM'd intraoral scanner on display. This move signals Graphy's ambitions to expand beyond their materials expertise and potentially offer a more comprehensive digital workflow solution.

Don't have time to read the full overview? Get the PDF

HeyGears - At Scale Printing Solutions

HeyGears' booth at AEEDC 2025 focused on demonstrating their established printer solutions, particularly their high-throughput manufacturing capabilities. While no new products were announced, their printers continued to draw attention for its automated production capabilities, especially in the clear aligner space for small to mid-sized labs.

The company's flagship automated solution can produce over 1000 clear aligner models overnight, positioning them as a serious player in this sector. Their automated workflow, which includes automatic print completion and model removal from the build platform, represents a significant step toward true lights-out manufacturing, although post-processing steps like washing and curing still require manual intervention.

This automation-first approach is reminiscent of Formlabs' automated workflow solutions, but HeyGears has carved out their own niche in the market, particularly appealing to larger laboratories and aligner manufacturing facilities where high throughput is essential. Their focus on industrial-scale production rather than chairside solutions differentiates them in an increasingly crowded 3D printing market.

IMES-ICORE - German Milling Solutions

IMES-ICORE's booth at AEEDC 2025 featured their established line of industrial milling systems. Without new hardware announcements, their focus remained on their proven high-end milling solutions that continue to serve larger laboratories and milling centers. Their systems, particularly valued for precision work with titanium and other challenging materials, maintain their position in the CAD/CAM segment of digital dentistry.

Ivoclar - Goodbye Vivascan?

Ivoclar maintained their presence at AEEDC 2025 with a large booth, focusing primarily on their comprehensive materials and equipment portfolio.

However, notably absent was their VivaScan intraoral scanner, which had been previously announced with much fanfare. Upon asking, apparently this scanner is going to be discontinued. Yikes. A white-labeled Planmeca Emerald scanner was always going to be a hard sell.

Their booth continued to showcase their strengths in ceramics, composites, and digital materials, demonstrating their ongoing commitment to these core segments.

Lilivis - Challenging CEREC Mills

Lilivis returned to AEEDC 2025 with their full system on display, notably featuring their dual-spindle chairside milling unit - one of the few direct competitors to CEREC's established milling technology. The dual-spindle design, which enables simultaneous milling with two burs, aims to match the speed and efficiency that has long been CEREC's domain in chairside CAD/CAM.

Their intraoral scanner was also on display, completing their end-to-end chairside solution. However, despite offering a complete ecosystem from scan to mill, Lilivis has yet to gain significant market traction. The challenge of competing in the chairside milling space is substantial, particularly given CEREC's decades-long head start and established reputation.

The timing of their market entry raises interesting questions about the future of chairside restorations. As 3D printing continues to evolve and gain acceptance for chairside applications, the investment required for traditional milling systems might become harder to justify for many practices. It will be interesting to see how Lilivis adapts their strategy in this evolving landscape.

Medit - Regional Momentum Continues

Medit's booth drew consistent crowds at AEEDC 2025, with their flagship i900 scanner prominently displayed. Despite a difficult year of transitions following their acquisition, the company's popularity in the Middle East region appears strong.

Their scanner software platform continues to set the benchmark in the industry, with its comprehensive suite of apps and intuitive interface still arguably the best in the market. The continuous development of their software ecosystem, all provided at no additional cost, remains one of Medit's strongest differentiators in an increasingly competitive scanner market.

While no new hardware was introduced at this year's event, the steady flow of visitors to their booth indicated that their existing portfolio still maintains solid appeal in the MENA dental market, even as they navigate their post-acquisition phase.

Panda Scanner - Focus on Smart IOS

Panda Scanner's booth at AEEDC 2025 centered on their Panda Smart IOS, with no new hardware announcements. The company continues to focus on establishing their primary scanner in the market, maintaining their position as one of the more affordable scanner options available.

While the Smart IOS represents their entry into the digital dentistry space, it will be interesting to see how they evolve their product line in future, particularly as the scanner market becomes increasingly competitive with new entrants and dropping price points.

Don't have time to read the full overview? Get the PDF

Planmeca - Waiting for More.

Planmeca maintained their presence at AEEDC 2025, showcasing their comprehensive line of digital solutions. While there weren't any major hardware announcements this time around, the company demonstrated continuous improvement through some software updates to their scanner software platform.

The booth displayed their familiar yet robust portfolio of digital solutions. While the industry eagerly awaits potential hardware updates, I for one am very interested to see if they are going to release anything new at IDS, as it has been over 5 years since we have seen any major hardware release. They did have their cart solution on show.

Redon - Regional Milling Powerhouse

Redon, one of the largest milling machine manufacturers in the Middle East region, maintained their presence at AEEDC 2025 with an expansive booth space. While no new hardware was introduced this AEEDC, their display effectively showcased their comprehensive range of mostly laboratory-focused milling solutions. Made in Turkey and quite popular in the region.

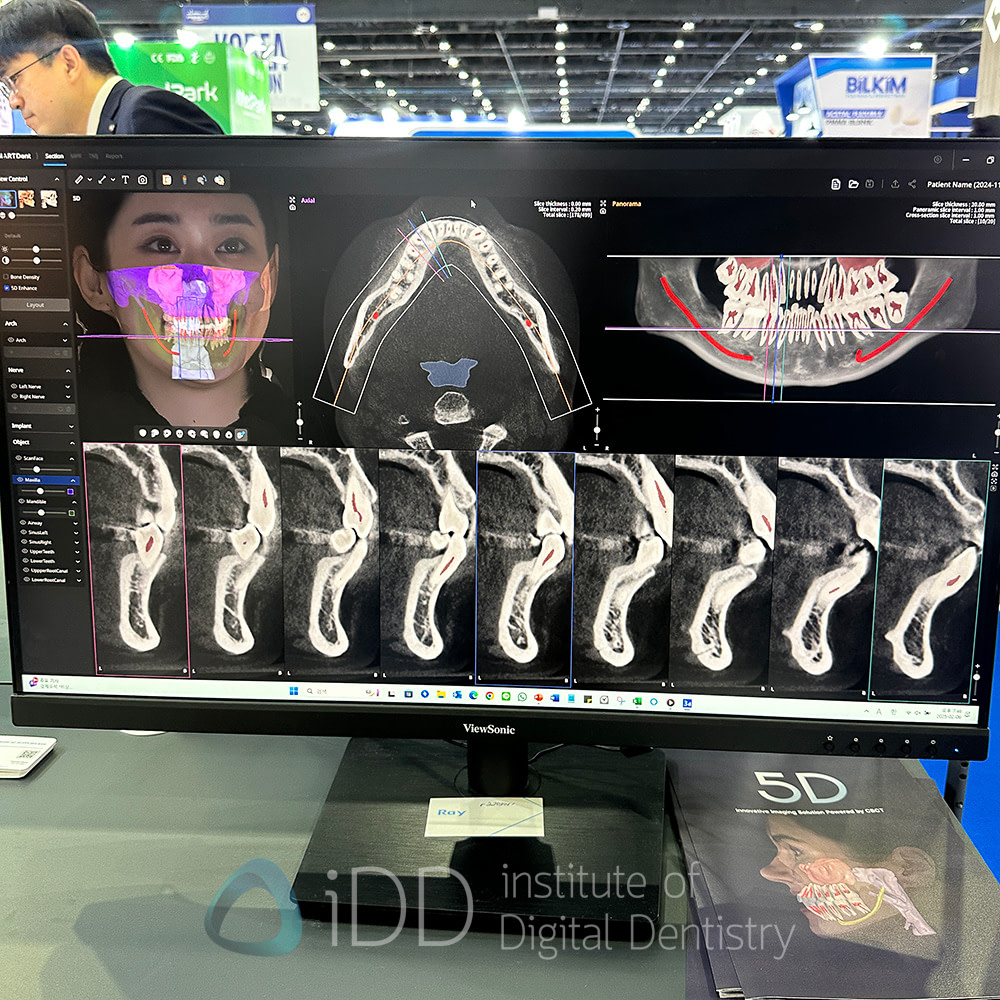

Ray - Innovating with Multi-Modal Imaging

Ray's booth showcased their new "5D CBCT" system, which integrates their CBCT technology with a RayFace scanner attachment in a single unit. The software behind this integration is particularly noteworthy, automatically aligning CBCT data with facial scans and performing sophisticated automatic segmentation.

However, Ray faces an increasingly competitive landscape in the facial scanning arena. The market has seen a surge of new entrants, from MetismiIe's dedicated hardware to iPhone-based scanning apps, and several new face scanning solutions that made their debut at AEEDC. This proliferation of facial scanning options poses an interesting challenge for Ray's position in this space.

The question now becomes whether Ray's approach of integrated CBCT-facial scanning, backed by their sophisticated software capabilities, will provide enough value proposition to maintain their edge in an increasingly crowded market. Their ability to offer seamless integration between radiographic and surface data might be their key differentiator as the facial scanning market continues to evolve. I have to say, when I tried the software it did look impressive.

RayShape - Established Printing Solutions

RayShape maintained their presence at AEEDC 2025, showcasing their established printer line with no new product announcements. Their Edge E1 printer, featuring 4K LCD technology and a 192 × 120 × 190 mm build platform, continues to serve the core dental applications from aligners and models to surgical guides and dentures. Their focus remains on providing accessible 3D printing solutions for dental professionals entering the digital space, with an emphasis on user-friendly operation and streamlined workflows.

Runyes - Expanding into Photogrammetry + Face Scanning

Runyes maintained their strong regional presence at AEEDC 2025, but what caught attention were their prototype displays pointing to ambitious future releases.

The company previewed several new products expected to launch at IDS, including a new wireless scanner, a face scanner that does look very similar to Rayface, and a shade-matching device.

However, their most intriguing prototype was a photogrammetry unit for full-arch implant scanning. This move into photogrammetry is particularly noteworthy given the market's recent evolution. The success of Shining 3D's Elite scanner has clearly demonstrated the dental industry's appetite for comprehensive full-arch implant scanning solutions.

Runyes appears to be positioning themselves to enter this space with their own offering, joining the growing trend of manufacturers looking to provide complete implant workflow solutions.

Saremco - Crown Printing Materials

Saremco maintained their presence at AEEDC 2025 albeit in a small booth, showcasing their popular line of crown printing resins. The company has established itself as a key player in the permanent crown resin market, particularly as 3D printing continues to gain acceptance as an alternative to traditional milling for restorative solutions.

As more practices explore chairside printing solutions for permanent restorations, Saremco's established position in this niche market segment may become increasingly significant. Will we see some new resins soon?

In an era where 3D printed crowns are moving from concept to clinical reality, Saremco's expertise in this category demonstrates how material manufacturers can succeed by focusing on specific applications rather than trying to cover the entire spectrum of dental materials.

Shining 3D - The Elite Surprised the Industry

Shining 3D commanded attention at AEEDC 2025 with an impressive display of their comprehensive digital dentistry ecosystem.

The Aoralscan Elite intraoral scanner, which has made significant waves since its launch, remained a centerpiece of their exhibition. Its speed, accuracy, and intraoral photogrammetry continue to earn praise from dental professionals across the globe.

Beyond scanning, their complete digital workflow was on full display – from their facial scanning technology for comprehensive treatment planning to their range of 3D printers for various dental applications. The integration between these technologies demonstrated Shining 3D's understanding of modern dental practices' needs for seamless digital workflows.

To improve this workflow even further, the company launched their new Cap Scanbodies which comes in the coded scan body kit. These cap scanbodies are there to help with alignment of the scans, especially in immediate loading cases, that often have bloody and moving tissues.

The company's booth effectively showcased how their various technologies work together to enable everything from simple restorative cases to complex full-arch rehabilitations. I am looking forward to their new product launches at IDS 2025, with Shining 3D reportedly preparing to unveil significant additions to their dental portfolio. While details remain under wraps, the company's recent R&D investments suggest we might see innovations across their entire digital ecosystem. It is incredible how fast this company is developing.

Don't have time to read the full overview? Get the PDF

Sprintray - MIDAS Front and Centre

SprintRay's presence at AEEDC 2025 was also nothing short of transformative – a dramatic evolution from their modest single-table setup last year to an impressive, commanding booth that drew attention. At the heart of their display was, of course, the SprintRay Midas, which has quickly positioned itself as a potential game-changing solution for chairside digital dentistry.

The Midas's prominence at their booth underscored SprintRay's clear message: chairside 3D printing is ready to challenge traditional milling as the go-to solution for same-day dentistry. With its lower price point compared to milling systems, the Midas presents a compelling entry point for clinics looking to adopt chairside digital workflows without the substantial investment traditionally required.

Their ecosystem approach was further reinforced by demonstrations of their cloud-based CAD design software and the Pro 2 + NanoCure printer system. The integration between these technologies showcased SprintRay's vision for accessible, efficient digital workflows. The company's demonstrations consistently emphasized how practices can transition from scan to final restoration in a single appointment, all while maintaining a more attractive price point than traditional milling.

To me, this elevated presence at AEEDC 2025 signals SprintRay's serious commitment to both the Middle Eastern market and their position as a leader in chairside 3D printing solutions. This is a huge difference to their booth last year.

I had the honor of lecturing at their booth and participating in a panel discussion alongside SprintRay's CEO Amir Mansouri, who made a personal appearance at the event. His presence underscored the company's commitment to the Middle Eastern market, while our discussions highlighted SprintRay's vision for making digital dentistry more accessible and affordable, a message that strongly resonated with practitioners looking to enter the digital space.

The question remains - are these restorative resins going to hold up long term? Time will tell.

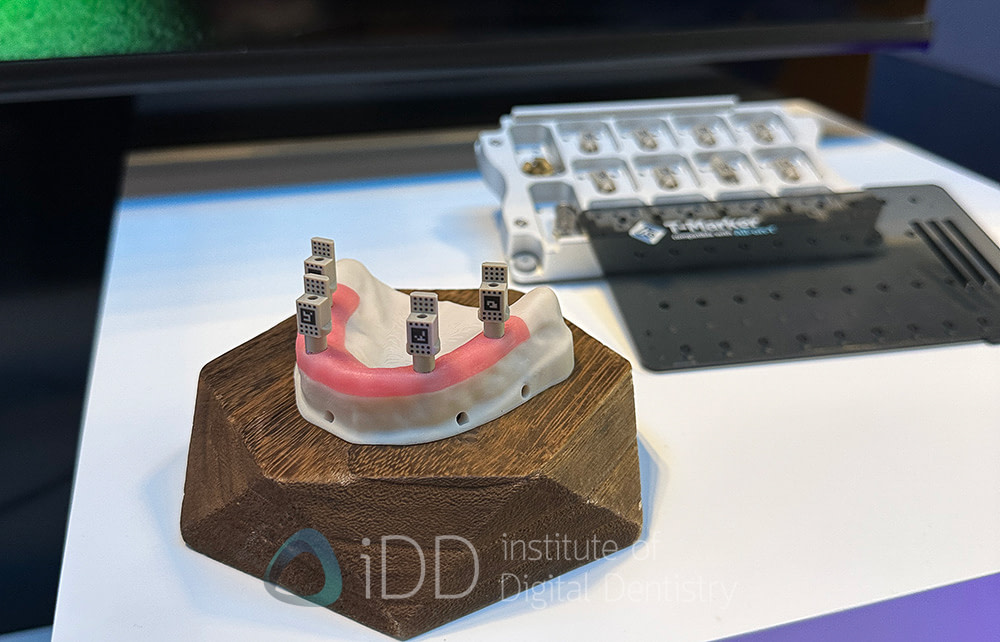

TruAbutment - Full Arch Solutions

TruAbutment's presence at AEEDC 2025 reflected their growing status in the digital dentistry space. Their IO Connect system has become one of the leading solutions for implant scanning workflow. This simplification of the implant full-arch scanning process has clearly resonated with clinicians.

At this year's event, they demonstrated their next potential game-changer: the T-Marker iPad-based photogrammetry solution. While still in development and not yet market-ready (and as with any booth demonstrations, real-world performance remains to be seen), the concept is intriguing. This T-Marker solution has also been seen at booths since last year, we are all waiting for the release.

The system appeared to use small, precisely engineered markers, combined with an iPad to capture full-arch implant positions. The promise of bringing photogrammetry capabilities to iPads could potentially make full-arch implant workflows more accessible to a broader range of clinics.

Their impressive booth setup and continued innovation in the full-arch implant space underscores a broader industry trend - the growing demand for accessible, efficient full-arch scanning solutions. TruAbutment appears well-positioned to capitalize on this trend, transforming from a component manufacturer to a comprehensive digital solutions provider. The company's rapid development of innovative products suggests they're one to watch closely in the coming years.

VHF - Established Milling Machines

VHF's booth at AEEDC 2025 featured their established line of milling machines, including their popular dental mills and aligner trimming solutions. While no new hardware was introduced, their reliable systems continue to serve various segments of the market - from compact chairside units to their well-known aligner cutting machines.

The company maintains its position in the market through their reputation for German engineering and reliability, particularly with their aligner trimming solutions which have become a staple in many clear aligner production facilities. Their focus remains on refining and supporting their existing product line rather than introducing new hardware.

3Dify - New Scanners on the Horizon

3Dify's booth at AEEDC 2025 showcased two new products that signal their growing ambitions in the digital dentistry space. Their new face scanner, one of three new face scanners launched at the event, highlighting the industry's increasing focus on comprehensive facial scanning solutions for treatment planning and patient communication. More notably, their latest intraoral scanner appeared to offer significant improvements over previous iterations. However, both devices were prototypes at the show, with full releases expected at IDS. Additionally, 3Dify also has a lab scanner in its portfolio.

The introduction of their face scanner, alongside similar launches from other manufacturers, underscores a key industry trend -the rising importance of facial scanning in digital workflows. With solutions like MetiSmile, iPhone-based alternatives, and now multiple dedicated hardware options, practices have an expanding range of tools for integrating facial scanning into their workflows.

Notable Company Absences

Several major players were notably absent from AEEDC 2025, marking interesting shifts in regional market focus. These being:

- Align Technology / iTero chose to skip AEEDC this year, particularly interesting given the imminent launch of their Lumina scanner in the region.

- 3Shape's absence was notable, given their scanners are popular in MENA. I find it interesting 3Shape never seem to have a booth at AEEDC but have a big presence at Chicago Mid Winter (a week later) and of course, IDS.

- Dentsply Sirona not present at AEEDC but maintained presence in the region via DS World that happened in Dubai a day earlier. Read my coverage of that event here.

- Formlabs' absence is noteworthy, especially as the 3D printing market continues to grow in the region

These absences might reflect shifting regional strategies or resource allocation towards other major events. However, most of these companies are expected to have significant presence at upcoming events like IDS 2025, suggesting a strategic choice in event participation rather than any broader market retreat.

Final thoughts

This year's AEEDC marked several significant shifts in digital dentistry. The surge in full-arch implant solutions and photogrammetry, signals a new chapter in how we approach complex dental procedures. The growing accessibility of digital technology, evidenced by scanner prices dropping to unprecedented levels, continues to lower barriers to entry for practices worldwide.

What stood out most was not just individual innovations, but the broader industry transformation. Traditional material manufacturers are becoming digital solution providers, scanner companies are expanding into AI and cloud services, and the lines between different sectors continue to blur. The number of companies offering comprehensive ecosystems rather than standalone products reflects a maturing industry that better understands practitioners' needs for integrated workflows.

With IDS 2025 just around the corner, it was clear many companies were holding back their major announcements. The relative scarcity of new launches at AEEDC suggests we're likely to see significant product releases at IDS, particularly in the scanner and chairside solution segments.

Even with companies keeping tight lipped about their big releases for IDS, the growth and evolution of AEEDC has been remarkable. What was once primarily a regional event has transformed into a serious fixture on the global dental calendar. The scale, organization, and international participation at AEEDC 2025 demonstrates how the Middle East has established itself as a crucial hub for the dental industry.

As we look ahead, three trends appear set to define the immediate future of digital dentistry: the democratization of technology through more affordable solutions, the rise of cloud-based and AI-driven services, and the increasing focus on comprehensive full-arch digital workflows. AEEDC 2025 didn't just showcase products; it presented a glimpse of where dentistry is headed – increasingly digital, more accessible, and more integrated than ever before.

Thanks for reading.

Dr Ahmed , great summary of the AEECD 2025. Thank you .

Thanks Bobby. Glad it is useful.

Thank you Ahmad ,that was helpfull

My pleasure. Check out our IDS post 🙂

https://instituteofdigitaldentistry.com/news/ids-2025-highlights-the-latest-breakthroughs-in-digital-dentistry/