Fresh from the bustling halls of AEEDC Dubai, stepping into Chicago's McCormick Place for the 160th Midwinter Meeting (MWM) offered a striking contrast - and I mean striking! Going from Dubai's 25°C (76°F) to Chicago's bone-chilling negative 18°C (-1°F) was quite the temperature shock. Let's just say my light wardrobe choices didn't quite cut it here...

While AEEDC impresses with its sheer scale of 4,800+ brands and 66,000+ attendees, Chicago Midwinter takes a different approach. This more focused show punches well above its weight in the global dental industry, powered by America's position as the world's largest dental market. Many companies view it as their springboard for product launches - and this year delivered several exciting ones (which we'll dive into below).

What makes Chicago unique is its dual-show format. The Chicago Midwinter Meeting caters specifically to dentists and clinics, while the concurrent LMT Lab Day focuses exclusively on dental laboratories. This creates a fascinating split personality, offering clear insights into how companies position themselves differently for these two distinct audiences.

The contrast between this largely American show and international expos like AEEDC is massive. Everything from the booth designs to the types of dental services showcased reflects distinct cultural differences and market priorities. It's remarkable how this relatively small show still draws product launches that companies held back from AEEDC - a show nearly five times larger. That alone speaks volumes about the American market's global influence. The concentrated presence of North American key opinion leaders, major distributors, and decision-makers clearly makes this show too important to pass up.

This year's meeting brought several significant developments that signal where dentistry is headed in 2025 and beyond. From material innovations to manufacturing breakthroughs, let's dive into everything noteworthy from this year's Chicago Midwinter Meeting.

In this post, I'll focus on the Midwinter Meeting highlights, with a separate deep dive into LMT Lab Day (read it here).

Key Industry Trends at CMWM 2025

Scanner Market Evolution in North America

Unlike AEEDC where budget scanners were much more present on the exhibition floor, Chicago Dental Society Midwinter Meeting reflected North America's distinctly different market dynamics. While the scanner market is still transforming rapidly, the focus here leans heavily toward mid-range and premium offerings. That's not to say affordable solutions weren't present, they were, but the flood of sub-$10K scanners so prevalent at AEEDC was notably absent from the exhibition floor.

This market difference makes perfect sense. North American dental practices typically have far higher purchasing power and different ROI calculations than many other global regions. While the trend toward more affordable scanning solutions continues worldwide, the North American market appears to be settling into a 'sweet spot' between accessibility and capability. Most scanner offerings at the show clustered in the $10K-20K range, with manufacturers emphasizing software capabilities, workflow integration, and precision over pure price competition.

What's particularly interesting is how even premium scanner manufacturers are responding to market pressure. Rather than racing to the bottom on price, they're increasingly differentiating through expanded software capabilities, specialized workflows, and enhanced integration with practice management systems. It's a more nuanced transformation than what we're seeing in other global markets - less about dramatic price drops and more about delivering comprehensive value to practices.

Full-Arch Implant Solutions Dominate

What discussion in North America would be complete without talking about full-arch implant treatment? This represents one of the most niche yet widely showcased segments in dentistry. Influential both in terms of clinical significance and revenue potential for practices, and was clearly reflected at Chicago Midwinter 2025, where digital workflows for full-arch cases are a major talking point.

The biggest news in this space came from 3Shape, who announced a significant collaboration with TruAbutment. There will be an integration of TruAbutment's IOConnect scan body technology directly into 3Shape's scanning software. The timing and nature of this partnership seems like a direct response to the waves created by Shining 3D's Aoralscan Elite in the market - and shows how seriously manufacturers are taking the full-arch scanning space.

I expect all major scanner companies to do something similar sooner or later - either produce their own horizontal scan bodies, or announce collaborations with other companies that make them. This is a major market trend now.

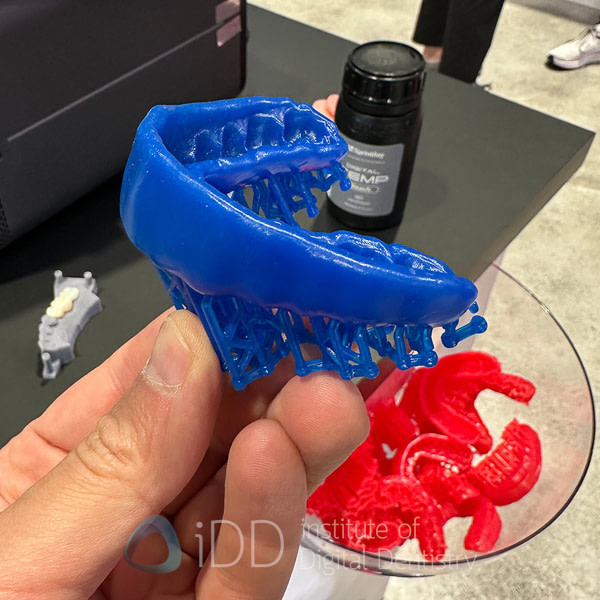

3D Printing's Restorative Revolution

If there was one technology generating the most buzz at Chicago Midwinter 2025, it was permanent 3D printed restorations. While the global dental industry is gradually warming up to this concept, the North American market is arguably leading the charge. Although still very niche, dentists here seem to be more open to embracing printed restorations.

SprintRay's Midas workflow generated significant attention on the show floor, reflecting the American market's growing appetite for chairside printing solutions. What's particularly striking is how the conversation has evolved - it's no longer about whether you can print permanent restorations, but how to integrate them most effectively into daily practice and which resin is going to be the game-changer.

Although still niche, the North American dental community is pushing the boundaries of what's possible with 3D printed restorations. Major manufacturers are responding accordingly, with several companies showcasing new resins specifically formulated for permanent restorations.

Here's what caught my attention, in alphabetical order, from each company:

3Shape - New Collaboration

After skipping AEEDC, 3Shape made their presence felt in Chicago with several significant announcements - some clinic based and many on the lab side.

The headline at the clinic-focussed show was their new collaboration with TruAbutment, integrating TruAbutment's IOConnect scan body technology directly into their scanning software. This partnership appears to be a direct response to Shining 3D's Elite scanner success, showing 3Shape's determination to maintain their strong position in implant workflows.

Looking beyond TRIOS, 3Shape's software solutions continue to evolve. Their focus remains on enhancing and integrating their digital workflows, particularly in high-value areas like implant planning and clear aligner design. While we didn't see major hardware announcements at this show, their strategic partnership announcements suggest 3Shape is focusing on strengthening their ecosystem through collaboration rather than just product development.

This approach makes sense in the North American market, where integrated workflows and comprehensive solutions often matter more than individual product features. The TruAbutment collaboration in particular I think is a great response to the rise of these types of solutions for full arch scanning.

Align - Big Presence in Home Market

After their notable absence at AEEDC, Align Technology commanded attention at Midwinter with one of the largest booths at the show - a reflection of North America's position as their dominant market.

The iTero Lumina scanner was front and center, showcasing its better scanning speed and reimagined ergonomics that we first saw at the scanner's launch last year. Much of their focus centered on their expanding digital ecosystem, particularly their vision for comprehensive practice integration.

The Oral Health Suite, which aims to bridge the gap between scanning and patient communication, was prominently featured. Similarly, the iTero Design Suite (cloud-based version of exocad) highlighted Align's push toward restorative workflows in the cloud. Otherwise no major releases for this year's MWM.

The elephant in the room was the conspicuously absent restorative software release for the iTero Lumina, which the company is calling "iTero Lumina Pro". Basically in the software side you still cannot use the Lumina for any restorative scans. When asked about its status, I am told we should expect its release by the end of March 2025. This timing suggests they're likely aiming for a major launch at IDS, where the global dental community will be watching closely.

I for one am curious to see how it looks as they have been working on it for some time.

Alliedstar - Growing North American Presence

While parent company Straumann was notably absent from the 2025 Midwinter Meeting (but present in a big way at Lab Day), Alliedstar made their presence felt with a substantial booth investment. Their scanner lineup, particularly the wireless AS200E, appears to be gaining traction as North American dentists increasingly seek more budget-friendly scanning solutions without compromising significantly on scan quality or software. It's interesting to see how Alliedstar is carving out their own identity in this market, even as their Straumann acquisition settles in.

Their scanner lineup, is headlined by the AS 260 and the wireless AS200E. The company is clearly positioning itself as a bridge between budget and premium scanner segments - offering more features than entry-level options while maintaining a more attractive price point than market leaders. Nothing new at this show.

Amann Girrbach

Notably missing from the clinical show. They have a huge presence in LMT Lab Day - read it here.

Stay updated and get the latest Digital Dentistry News on Scanners, Mills and 3D Printers.

We Will Email You When We Publish A New Article So You're The First To Know!

AOX - AI-Powered Full-Service Full-Arch Solutions

Dentbird's spin-off venture AOX represents a fascinating pivot that speaks volumes about the North American market's appetite for full-arch solutions. Rather than just offering software or components, AOX has launched as a comprehensive service provider with a clear focus: making all-on-X treatments more accessible and streamlined for clinicians.

What makes this venture particularly interesting is how they've built it. While operating under a completely new brand and identity, AOX leverages Dentbird's AI design capabilities. They've established a full-service laboratory operation in the USA that handles everything from design through production - offering the complete spectrum of full-arch solutions including temps, zirconia bridges, titanium bars, thimble bars, overdentures, locator bars, and virtually every other type of full-arch restoration imaginable.

This all-in-one approach, combining AI-powered design with local production at competitive price points, demonstrates where dental laboratories are headed. It's not just about offering services anymore, it's about leveraging artificial intelligence to deliver consistent, high-quality results while maintaining affordability.

AOX's emergence suggests that the future of dental CAD isn't just about software, it's about comprehensive solutions powered by AI.

Asiga - Precision Meets Innovation

While Sprintray's chairside solutions make a lot of noise in the industry and often take much of the spotlight clinic side, Asiga's presence at Chicago Midwinter revealed several significant developments that shouldn't be overlooked. Their presence at the clinic-focused show, rather than exclusively at Lab Day, signals their growing ambitions in the chairside space while maintaining their dominance in the laboratory market.

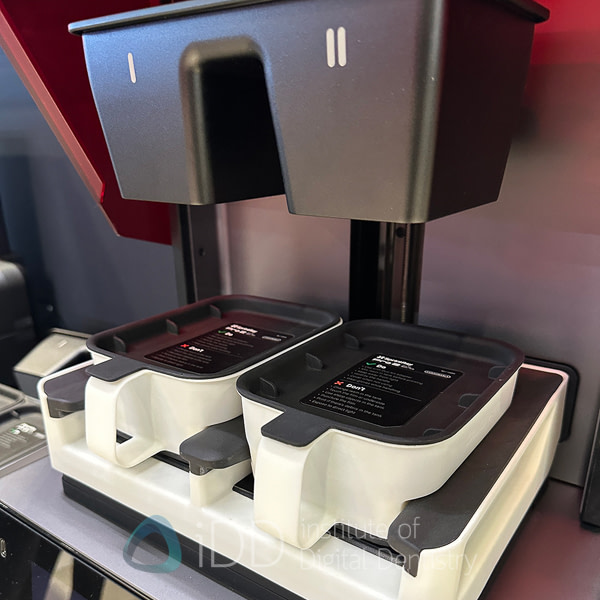

The company actually had a huge day. They unveiled three new proprietary resins - a soft night guard material, a flexible denture resin, and an orange tray resin - how well these work is anyones guess but the fact they are expanding their materials portfolio beyond their traditional offerings is a great sign. Resin is nice, but the hardware announcements were where things got really interesting:

The popular Asiga MAX 2 has received notable upgrades, including an enhanced heating system and a redesigned latch mechanism with improved resin tray compatibility. This will be the case for anyone who buys them going forward. For clinicians demanding very high precision, for example those who print a lot of full-arch implant restorations, the company has introduced a new 50-micron variant of the MAX 2 printer. An interesting pivot and option to give clincians.

We finally have a crown kit for the Asiga Max and Ultra. The company showcased here for the first time at Chicago Midwinter and thankfully it also comes with a small sized resin tray. Something that I feel Asiga has been a bit late to the party with but I am glad it is here now.

However, the best announcement was their new cure box - a product I have been awaiting for years. While their washing solution remains in development (the company is apparently holding it back until they're fully satisfied with its performance), I got to see the cure box which actually had some great features:

Available in two chamber sizes, it incorporates a remarkably quiet vacuum pump for oxygen-free curing. Additionally, there is the rear nitrogen gas connection, offering optional nitrogen curing capabilities without making it mandatory. The unit even has an attachment for another vacuum pump if you wish to make the curing process even faster (the current pump within the machine takes a few minutes to suck all the air out). Overall I am told the cure times are fast, with everything being able to be cured within 10 min.

What impress me was the flexibility and software side. The UI looks modern like the Asiga Max 2 / Ultra and gives you full freedom whether you want to use the vacuum pump or not. The unit also has this neat feature of detecting the number of parts within the curing unit and automatically adjust curing parameters accordingly to ensure everything is cured properly - a thoughtful touch that reflects Asiga's attention to detail in engineering.

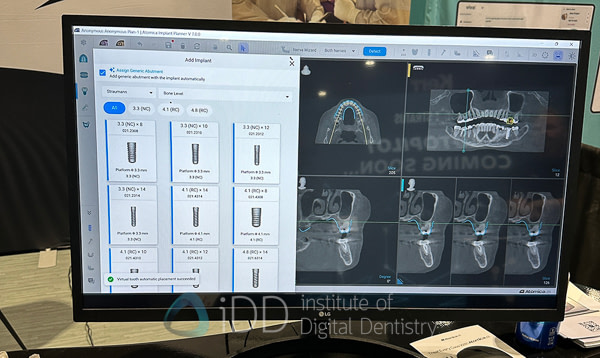

Atomica.AI - Maintaining Momentum

Fresh from their AEEDC appearance, Atomica.AI maintained their presence at Midwinter with no new announcements. Their booth continued to showcase their AI-driven services like implant planning, surgical guides, stackable guide design, smile design, splints and AI segmentation solutions, while also highlighting their expansion into restorative CAD. Their presence at both major shows within weeks of each other demonstrates their commitment to building global market awareness.

BEGO

No sign of BEGO in the clinic show. They have a presence in LMT Lab Day - read it here.

Borea Cobra - Refined Shade Matching

Borea was also at Midwinter, showcasing their Cobra shade matching device. I have reviewed this device and found it to be one of the best on the market right now. While no new hardware or features were announced, their shade matching technology continues to offer an alternative to traditional visual shade selection methods. Their focus remains on their core competency – accurate, repeatable shade analysis that helps eliminate guesswork from restorative workflows.

COXO - Regional Strategy Shift?

COXO, In an interesting pivot from their expansive AEEDC presence, COXO's smaller Midwinter booth emphasized their endodontic lineup over their scanning solutions. This strategic shift may highlight how differently the North American market approaches value-based dental technology compared to other regions.

Dentbird

While Dentbird itself focused their presence at LMT Lab Day (where AI design solutions are gaining traction among labs), they opted not to exhibit at Midwinter Meeting. Instead, their new venture AOX took the stage at the clinical show - a telling strategic choice that reflects a key market reality: laboratories are embracing AI design tools, while clinicians are seeking complete treatment solutions. This strategic split between Dentbird for labs and AOX for clinics offers an fascinating glimpse into how companies are crafting distinct identities and solutions for these two different markets.

Dentsply Sirona - Waiting for IDS?

Dentsply Sirona remains a leading force in digital dentistry, offering a comprehensive portfolio of equipment and solutions, including CAD/CAM systems, imaging technology, and dental consumables. Their ecosystem is known for seamless integration and high reliability, supporting efficient workflows from diagnosis to final restoration. Present at Midwinter with a large booth they showcased the entire range of solutions. No major product announcements are expected before IDS, keeping the dental industry curious about their next move.

DG Shape - Steady in the Milling Space

No sign of DG Shape in the clinic show. They have a big presence in LMT Lab Day - read it here.

Stay updated and get the latest Digital Dentistry News on Scanners, Mills and 3D Printers.

We Will Email You When We Publish A New Article So You're The First To Know!

DOF - New Scanner, Crowded Market

DOF (Digital Optical Factory), long established in the dental imaging space, showed off their new Freedom Air scanner at Midwinter. The company has an interesting history - they've been developing scanning technology since 2012 and are well-known for their laboratory scanners like the Freedom series. Many might not know they were also early collaborators with Medit in developing scanning technology.

Their new scanner will be officially launched soon, featuring a notably more compact design than their previous offering. The scanner enters an increasingly saturated market where established players dominate and even strong technical offerings struggle to gain traction. In a landscape where software capabilities and ecosystem integration often matter more than hardware specs, new scanner launches face an uphill battle for market share.

Eighteeth

Eighteeth did not have a booth at Midwinter, despite a major presence at AEEDC just a week earlier, reflects how different these markets are and perhaps the limited appetite for ultra-budget scanners in the North American market.

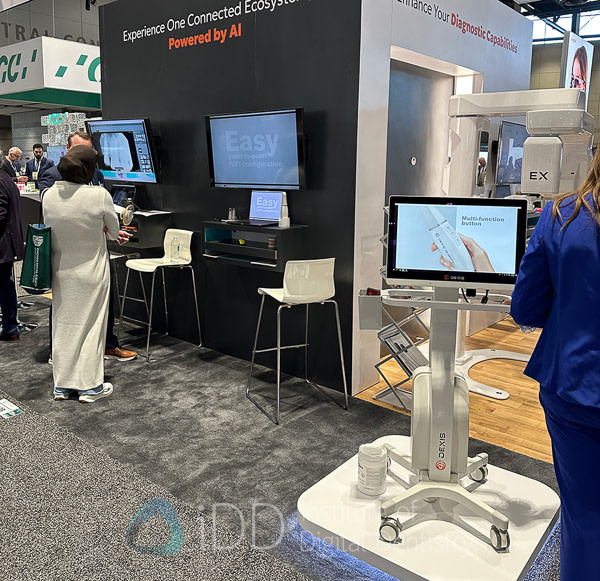

Envista - Refining Their Digital Portfolio

While their core hardware lineup remained unchanged since AEEDC, Envista's Midwinter booth put their imaging capabilities in the spotlight. Their CBCT technology and more importantly - their impressive AI-powered software features are the main things that interest me here. The sophistication of their imaging algorithms and automated analysis capabilities demonstrated how AI is transforming diagnostics - signaling that advanced software capabilities are becoming as important as hardware specifications in the imaging space.

Fussen

Another absence from Midwinter, despite a major presence at AEEDC just weeks earlier.

GC - Business as Usual

Like several other major manufacturers at Midwinter, GC kept their display focused on their proven product line, for digital dentsitry, this was their LiSi CAD/CAM materials. New shades have been released but apart from that, nothing new.

While the lack of new announcements might suggest upcoming releases at IDS, for now they're maintaining their established position in the materials market. Also no sign of any intraoral scanners like they attempted last IDS.

Glidewell - Lab Giant's Strategy

As one of the world's largest dental laboratories, Glidewell's presence at Midwinter offered interesting insights into their product distribution strategy. Their booth showcased their milling systems and their proprietary CAD software - the same platform they use in their massive laboratory operations. While making their internal lab software available to the broader market is an interesting move, I personally havent heard too much about it and it doesnt seem to have gained significant traction against established players like 3Shape and exocad, which remain the industry standards for dental CAD. Still it is cool to see this absolute beast of a company make a showing.

Graphy - Direct Print Aligners

No sign of Graphy in the clinic show. I assume I will see them Lab side.

Stay updated and get the latest Digital Dentistry News on Scanners, Mills and 3D Printers.

We Will Email You When We Publish A New Article So You're The First To Know!

HeyGears - Dual Show Presence

Present at both Lab Day and Midwinter, HeyGears' clinic-side booth put their A2D HD printer system in the spotlight. While not a brand new release (it came out last year), this automated "desktop mini-lab" showcases impressive capabilities - it can print 5 full arch models in just 20 minutes with 95% multi-batch consistency.

The system features one-click part removal and automatic chip recognition for materials, a nice feature for chairside use and something that we see built into the wash units of other devices and not the printer itself which is interesting.

Their complete workflow includes printing, washing, curing, and their latest addition - a vacuum chamber that achieves polish-free results for night guards, putting them alongside other manufacturers offering glossy finish solutions.

The A2D HD's 4K resolution upgrade aims to deliver even better surface quality, demonstrating HeyGears' focus on both automation and precision in the chairside space.

IMES-ICORE - German Milling Solutions

Not present in the clinic show. They have a big presence in LMT Lab Day. Read it here.

Ivoclar - Goodbye Vivascan.

Ivoclar's substantial Midwinter booth focused on their traditional strengths - materials and equipment. The Vivascan intraoral scanner absence was even more notable here in the North American market, with company representatives officially confirming it is phasing out.

This early exit of their white-labeled Planmeca Emerald scanner from the market highlights the challenges of entering the increasingly competitive scanner space without a truly differentiated offering. Meanwhile, Ivoclar continues to excel in their core competencies, with impressive displays of their ceramic, composite, and digital material innovations.

We are all very excited to see what happens with the Sprintray collaboration in the future.

Kuraray Noritake - New Zirconia

In a show where 3D printing dominated many conversations, Kuraray Noritake demonstrated they're still innovating in the traditional materials space.

Their new zirconia material, which can be sintered in just 9 minutes using the Speedfire furnace, represents a significant advancement in chairside milling workflows. This ultra-fast sintering capability directly addresses one of the main challenges of chairside zirconia - the traditionally long processing times that made same-day delivery challenging.

The timing of this release is particularly interesting. Just a few years ago, a 9-minute sintering time would have been the talk of the show, potentially revolutionary for practices focused on same-day restorations. However, at Midwinter 2025, the landscape seems to have shifted dramatically. While this material innovation is impressive from a technical standpoint, the palpable excitement around 3D printed restorations suggests we might be witnessing a larger transition in chairside dentistry.

This isn't to diminish the achievement. Many practices may benefit from faster sintering times, and zirconia remains a proven, reliable restorative material. But watching the flow of attention at this show, it's hard not to wonder if we're seeing a pivotal moment in chairside dentistry, where even significant improvements in traditional workflows are being overshadowed by the promise of additive manufacturing.

Medit - Gearing up for IDS?

No new releases at Midwinter, with the Medit i900 scanner and their software ecosystem on display. The company continues to promote their comprehensive app suite and scanner technology, but appears to be holding any potential announcements for IDS.

Their core selling point remains unchanged - an extensive software platform included at no additional cost, paired with their proven scanning technology.

For those who do not know, they did recently reduce the cost of their i900 and other scanners. At launch, the scanner was priced at $24,500 USD, but at the start of 2025 Medit has brought down the price to $20,999 USD with a packaged laptop, or $18,999 USD for the scanner only. Market pressure.

Ori Scan 2.0 - Subscription Based Model

The Ori 2.0 intraoral scanner, introduced at the Chicago Dental Society Midwinter Meeting last year, offers dental professionals a subscription-based model designed to enhance accessibility and affordability. Practices can get the scanner with minimal upfront costs in the form of a subscription, starting at $450 per month and $350 for extra scanners. No other costs. Free replacement etc. Just like many other services these days for example WHOOP etc.

Fascinating model for a intraoral scanner business. Despite these clear cost advantages, the Ori 2.0 faces competition from established market leaders who offer more advanced features and arguably better scanning. It will be interesting to see what this company does in the future.

Overjet - AI Diagnostics in Home Market

A key player in the dental AI space, Overjet's Midwinter presence highlighted their position in their home U.S. market - the only region where their technology is currently available.

Their FDA-cleared platform competes directly with Pearl in automated radiograph analysis, offering capabilities like caries detection, bone level measurements, and comprehensive case presentation tools.

While both companies target similar clinical needs, Overjet's exclusive focus on the U.S. market is interesting. Personally I have not used it yet but hope to do a review at some stage as we have for other AI tools.

Stay updated and get the latest Digital Dentistry News on Scanners, Mills and 3D Printers.

We Will Email You When We Publish A New Article So You're The First To Know!

Pacdent - Quality Third-Party Materials

With presence across both shows, Pacdent continued to demonstrate their strength in the third-party resin market. Their Titan and Sculpture lines have earned a reputation as some of the best alternatives to manufacturer-specific resins, particularly giving Sprintray's materials some competition.

While they didn't launch anything new at this show, their established portfolio highlights how focused material development and consistent quality can create successful alternatives to proprietary resins. As 3D printing continues to gain momentum in dentistry, especially in the chairside space, Pacdent's position as a leading third-party material manufacturer becomes increasingly significant.

Panda Scanner - Finding Their Footing

Following their AEEDC appearance, Panda Scanner maintained presence at Midwinter - a notable commitment to the North American market. Their Panda Smart IOS remained the focus, with no new announcements to report.

Pearl - AI Market Leaders Maintain Course

Pearl maintained their established presence at Midwinter, showcasing their comprehensive AI-powered radiograph analysis platform. Humble booth. Nothing too spectacular.

No new major announcements, but their proven solution for automated X-ray analysis, insurance claim validation, and clinical findings continues to set the standard in dental AI. Their software and UI / UX remains impressive in an increasingly competitive AI landscape.

Planmeca - Still Waiting for Big Updates

No major hardware announcements from Planmeca, though they did showcase two new features: titanium tibase milling capability 'coming soon' to their chairside mill (though the timing remains vague), and a new augmented reality software solution. With their core hardware lineup remaining unchanged for over 5 years now, all eyes are on IDS for potential significant updates. I really am perplexed as to what the chairside strategy is for this once very competitive company.

Ray - Regional Strategy in Play

Unlike their product showcase at AEEDC where their new 5D CBCT system took center stage, Ray's Midwinter presence focused on their established product line. Their booth highlighted their CBCT units and the RayFace scanner, demonstrating their core imaging strengths in the North American market. Nothing new.

Runyes - Ambitious Product Pipeline Reaches NA

Following their comprehensive showcase at AEEDC, Runyes brought their full lineup of upcoming innovations to the North American audience at Midwinter. Their displays generated interest, particularly their entry into the photogrammetry space for full-arch implant scanning. This more affordable approach to photogrammetry could be especially relevant for the North American market, where full-arch implant work represents a significant revenue stream for practices but the current solutions often come with hefty price tags.

I still believe photogrammetry is a transitional solution and in light of horizontal scan bodies from TruAbutmnet and the Shining 3D elite solution, I am not sure it is as relevant anymore.

Their other products - including a new wireless scanner, a face scanner possibly inspired by RayFace's success, and a shade-matching device - demonstrate Runyes' ambition to offer a complete digital ecosystem. While all these products are still awaiting their official launch at IDS, their preview at Midwinter suggests the company is serious about establishing a stronger presence in the North American market with a comprehensive, value-conscious digital portfolio.

Shining 3D - Elite's North American Momentum

Following their impressive AEEDC showing, Shining 3D maintained strong presence at Midwinter with their Aoralscan Elite taking center stage. The scanner's photogrammetry capabilities for full-arch implant workflows appear to be resonating particularly well with the North American market. Their comprehensive ecosystem was on full display - from scanning through to 3D printing - though it was clear the Elite scanner remains their star attraction in this market.

The show highlighted how Shining 3D has evolved from being seen as "just another scanner company" to a serious competitor in the mid-to-premium scanner space, particularly in implant-focused practices. Their new cap scanbodies for challenging immediate loading cases also were showcased, while their integrated workflow solutions demonstrated their growing understanding of North American practice needs.

While everyone is eager to see what they'll unveil at IDS 2025, their current momentum in North America suggests they've found a sweet spot in the market with their high-end scanning technology and implant-focused solutions.

Sprintray - Taking Center Stage

The most impressive booth at Midwinter backed up its presence with significant announcements. It was hard to miss the giant inflatable midas around the show and their midas-themed booth in the hall.

After an impressive but notably announcement-free showing at AEEDC, Sprintray arrived at Chicago ready to make waves. The palpable excitement around their technology translated into a constant stream of curious clinicians, all eager to see what's next in chairside printing.

Their new DUO Kit represents one of the most practical innovations we've seen in dental printing. By incorporating two build platforms and a specially designed resin tray that enables simultaneous printing with two different resins, they've effectively doubled production capacity while adding crucial workflow flexibility. Imagine printing permanent crowns alongside surgical guides in a single run, or denture base and teeth - this kind of practical efficiency shows deep understanding of real clinical needs.

The company continues to expand their materials portfolio aggressively too. Their new HT (High Translucency) crown resin just launched and targets the demanding restoration space, aiming to deliver both aesthetics and durability. Meanwhile, a new sports guard material has been launched as well.

Since the Midas launch last year transformed their market position, Sprintray hasn't slowed down. Their booth consistently emphasized how practices can transition from scan to final restoration in a single appointment, all while maintaining a more attractive price point than traditional milling systems. The integration between their cloud-based CAD design software, printing technology, and expanding material options showcases their vision for accessible, efficient digital workflows.

While other companies talk about chairside printing's potential, Sprintray keeps delivering tangible solutions that make it more accessible and efficient. The fundamental question that started with Midas remains - will these materials stand the test of time in the oral environment? But what's clear is that Sprintray isn't waiting around for others to define the future of chairside printing. They're building it themselves, piece by piece, and the market's response at Chicago suggests they're onto something big.

Stay updated and get the latest Digital Dentistry News on Scanners, Mills and 3D Printers.

We Will Email You When We Publish A New Article So You're The First To Know!

TruAbutment - Full Arch Solutions

While their hardware offerings remained unchanged from AEEDC, TruAbutment's Chicago presence was notable for their newly announced collaboration with 3Shape. This strategic partnership integrates their proven IOConnect scan body technology directly into 3Shape's scanning software - a significant development in the highly competitive full-arch implant scanning space.

Their T-Marker iPad-based photogrammetry solution there but remained in development phase. The spotlight instead was clearly on the 3Shape collaboration, suggesting TruAbutment's understanding that partnerships might be as crucial as product development in the increasingly complex digital dentistry landscape.

This move appears particularly well-timed given the growing demand for streamlined full-arch workflows in the North American market.

Velmeni - Entering the AI Arena

First time exhibitor at Midwinter, Velmeni showcased their expansion into dental AI. With FDA approval already secured for 2D analysis and their recent launch into 3D, they're positioning themselves as a more affordable alternative to established players like Pearl and Overjet.

Their CBCT automatic validation feature, which confirms proper scan execution, demonstrates some innovative thinking. However, they're entering a space where competitors have already built robust, refined solutions and strong market presence.

The dental AI market, while growing rapidly, is becoming increasingly competitive with well-established players who have significant head starts in both technology and market adoption. Will be interesting to see how this plays out.

VHF - The Same Chairside Mills

Present at both Midwinter and Lab Day, VHF took different approaches for each audience. Their clinic-side booth maintained a targeted focus on their chairside milling solutions, while saving their broader portfolio including aligner trimming systems for the lab show.

No new hardware announcements at either location, but their established reputation for German engineering and reliability continues to resonate in both markets.

Zylo - All-in-One Printing Solution

Making their industry debut at Chicago Midwinter, ZYLO 3D unveiled their ambitious entry into the dental 3D printing space with the ZyloDent system. This new all-in-one solution integrates printing, washing, and curing into a single compact unit - joining a small but growing category of automated printing solutions targeting the chairside market.

What sets the ZyloDent apart is its complete integration of post-processing steps within one housing. Unlike other automated solutions like Primeprint or HeyGears' systems where washing and curing units remain separate, ZYLO has managed to incorporate everything into one device. This approach promises to minimize handling and streamline workflow, though their single wash container design raises interesting questions about post-processing protocols, given that most dental applications typically promote multiple wash cycles.

Will be interesting to see how dentists respond to this one. At around 13k USD it is certainly an interesting release.

Final thoughts

The Chicago Midwinter Meeting offers a fascinating window into the unique characteristics of the North American dental market. While physically smaller than mega-shows like AEEDC or IDS, the concentrated energy and influence here is undeniable. The American approach to dental exhibitions is distinctly different - there's an infectious enthusiasm in the halls that feels unique.

What really stood out to me in this show apart is the huge presence of practice management, insurance and AI solutions. Unlike other global shows where hardware and materials dominate, Chicago's Midwinter hall was filled with booths showcasing AI in some way or form - receptionists, automated practice management systems, diagnostics and marketing solutions. This heavy emphasis on practice efficiency and automation reflects both the sophistication of the American market and perhaps its challenges. Of course there are also huge booths by the massive distributors in this region like Henry Schein and Patterson which is a fascinating dynamic here.

The regions technology-forward mindset is hard to miss and extends beyond just practice management. Whether it's the strong interest in chairside printing solutions, full-arch digital workflows, or cloud-based services, the North American market continues to demonstrate its willingness to embrace new technologies that can enhance practice efficiency and patient care. More than anywhere I have seen in the globe.

The show's timing and significance - drawing major announcements despite being just weeks before IDS - reinforces North America's continued influence on global dentistry. Companies understand that success here often predicts success globally, making Chicago Midwinter an essential platform despite its more modest size.

Thanks for reading.

Stay updated and get the latest Digital Dentistry News on Scanners, Mills and 3D Printers.

We Will Email You When We Publish A New Article So You're The First To Know!