Align Technology is expanding its software ecosystem around the iTero scanner platform, with three major releases scheduled for the end of 2025.

The company shared its roadmap with me, revealing a clear strategy to integrate scanning, patient communication, and clinical workflows into an interconnected platform.

Solutions that combine platforms and scanner ecosystems are the name of the game for 2026 and beyond.

The Platform Evolution

Since 2022, Align has released nine major software updates across three product lines: the Align Oral Health Suite, Invisalign Outcome Simulator Pro, and iTero Design Suite, each addressing a specific challenge in general practitioners’ workflows through chairside innovations.

The 2025 releases represent the third generation of their clinical software stack, demonstrating a serious approach to providing clinical solutions to their customers. Align is serious about changing the perspective of iTero scanners from the 'Invisalign Scanners'.

This also appears to be a coordinated strategy to position iTero as more than just a scanning device. With the release of the Lumina, they have a great scanner; now they need everything surrounding it to work perfectly so it's integrated well within a clinic’s workflow

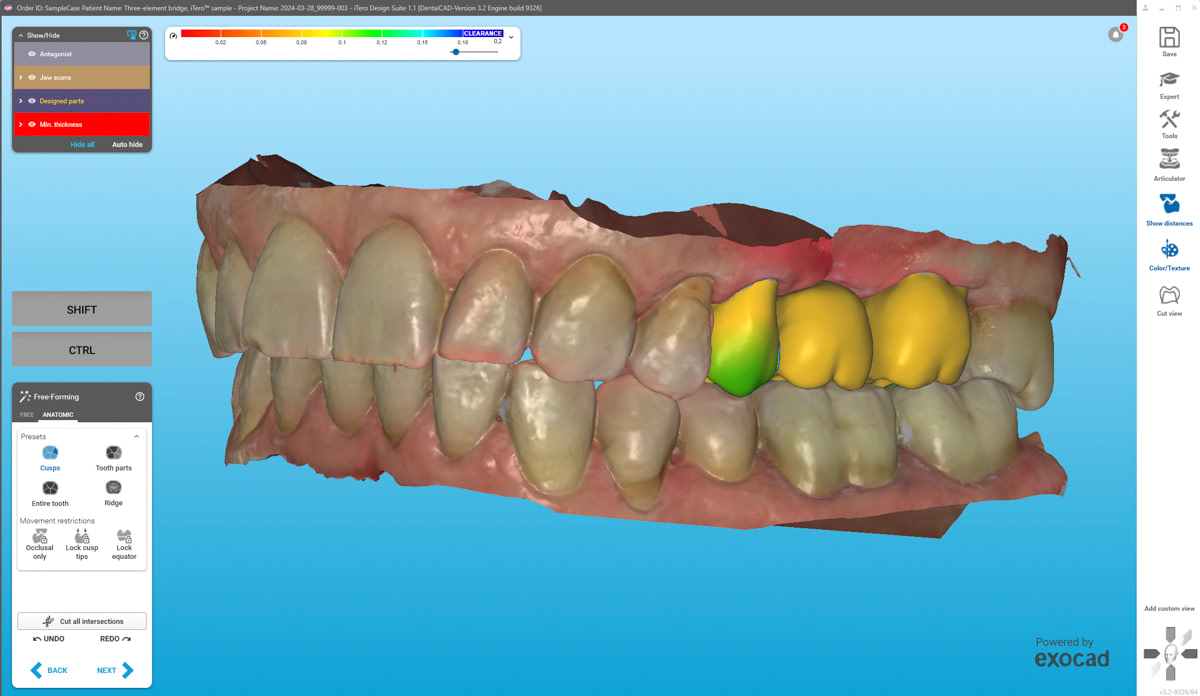

The current 2026 lineup includes new versions of:

- Align Oral Health Suitex

- Invisalign Outcome Simulator Pro

- iTero Design Suite

- iTero-exocad Connector v2 (maintained from 2023)

Align Oral Health Suite - Enhanced Patient Communication

Align Oral Health Suite was launched 2 years ago and has been a valuable addition to iTero, improving patient communication and treatment acceptance. iTero reports that studies by clinicians and staff show that adoption of the Align Oral Health Suite led to increased treatment acceptance and practice growth (read more here).

The third generation of Align Oral Health Suite focuses on patient education and clinical documentation with these key features:

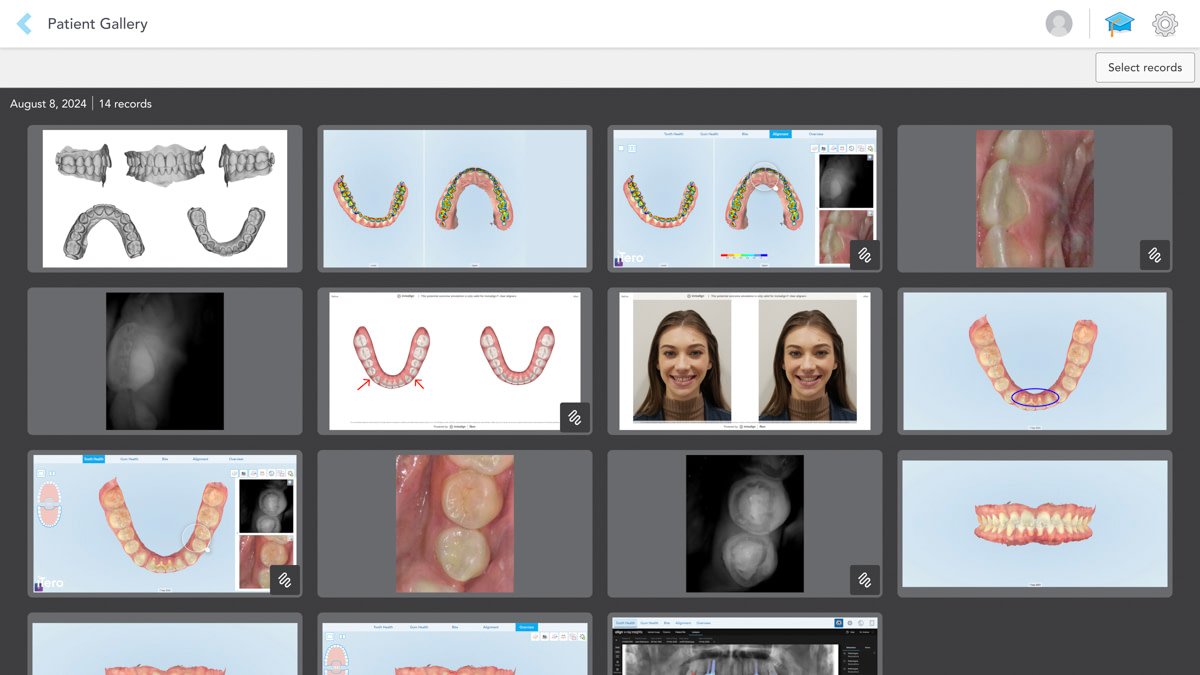

Patient Gallery - A collection system for all patient records, including NIRI imaging, intraoral photographs, wide smile photos, simulation images, videos, and snapshots with saved notes. This consolidates what previously required multiple systems into a single repository for tracking patient history and customizing communication workflows.

Oral Health Report - Better reporting with image captions, annotations, and multimodal presentation in patient-friendly terminology. The key here is chairside shareability, enabling reports that extend beyond clinic walls to support patient engagement and recall communication.

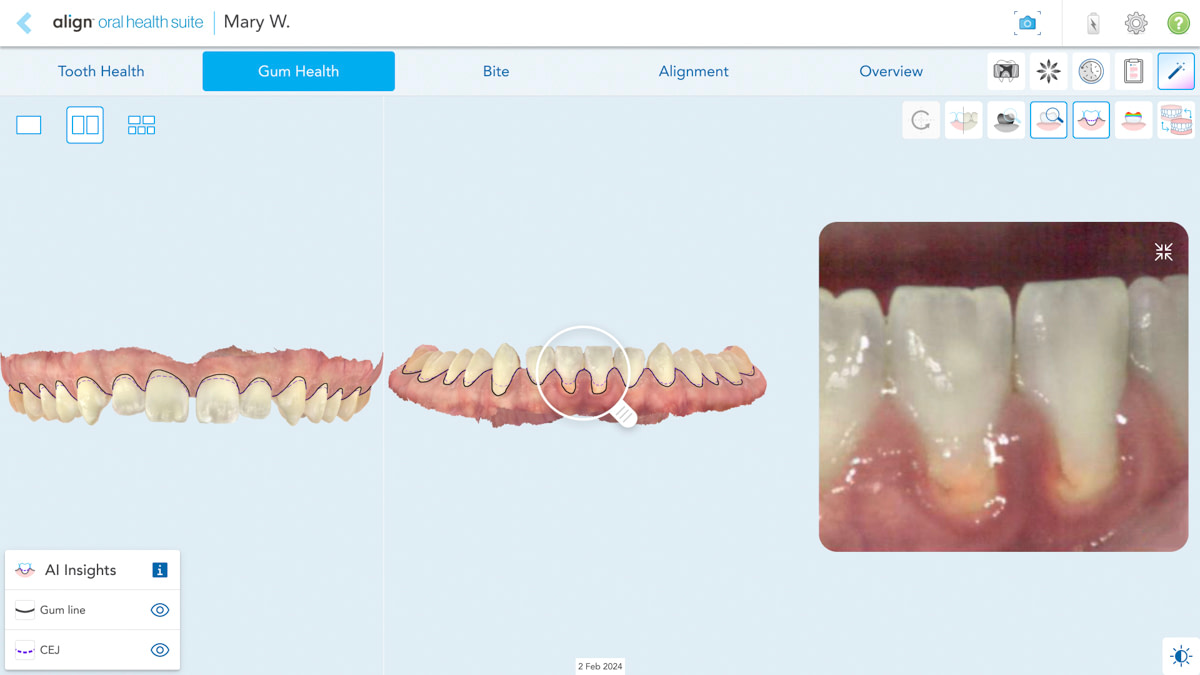

Gumlines Visualization (limited release) - A new, AI-powered feature that visualizes current gingiva line location versus the CEJ (cement-enamel junction) line, with options to display one or both lines. This allows visualization of gingival heights on both buccal and lingual surfaces, enabling more accurate analysis and a comprehensive perio-ortho relationship assessment.

This is something we are seeing more and more in the market (starting with TRIOS 6) that addresses a specific clinical need for patient education regarding periodontal health conditions and treatment planning.

The value proposition is clear: better documentation, improved patient communication, and streamlined examination workflows.

Invisalign Outcome Simulator Pro

The third generation of their visualization tool introduces three significant capabilities:

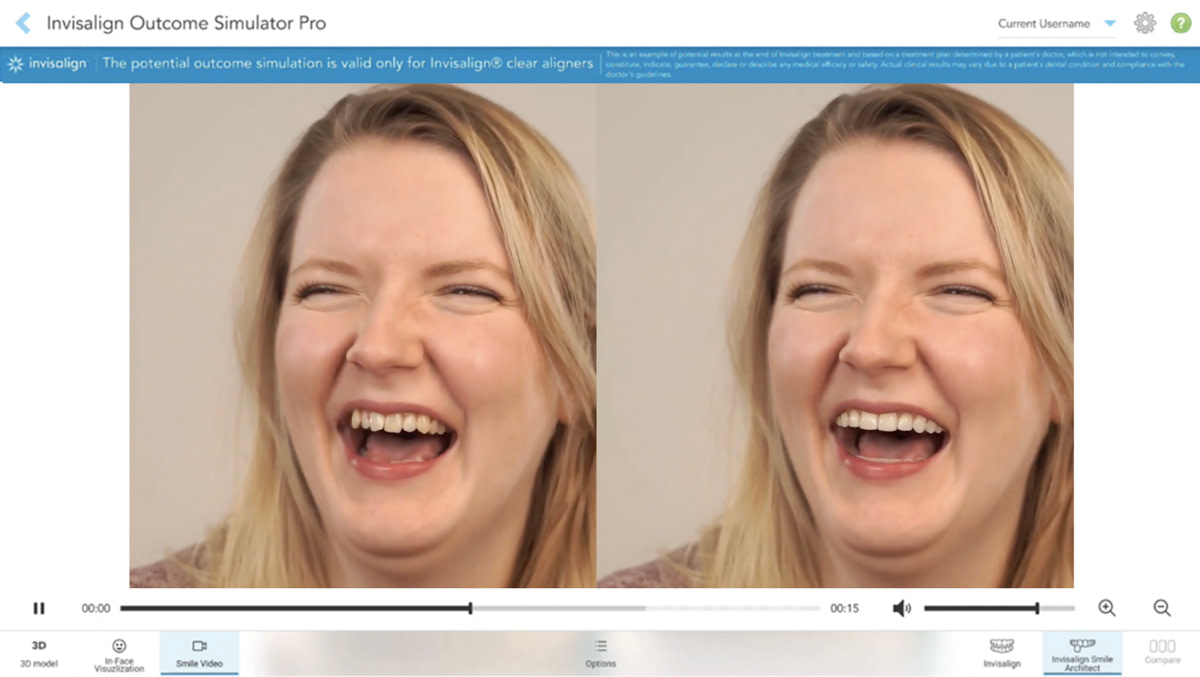

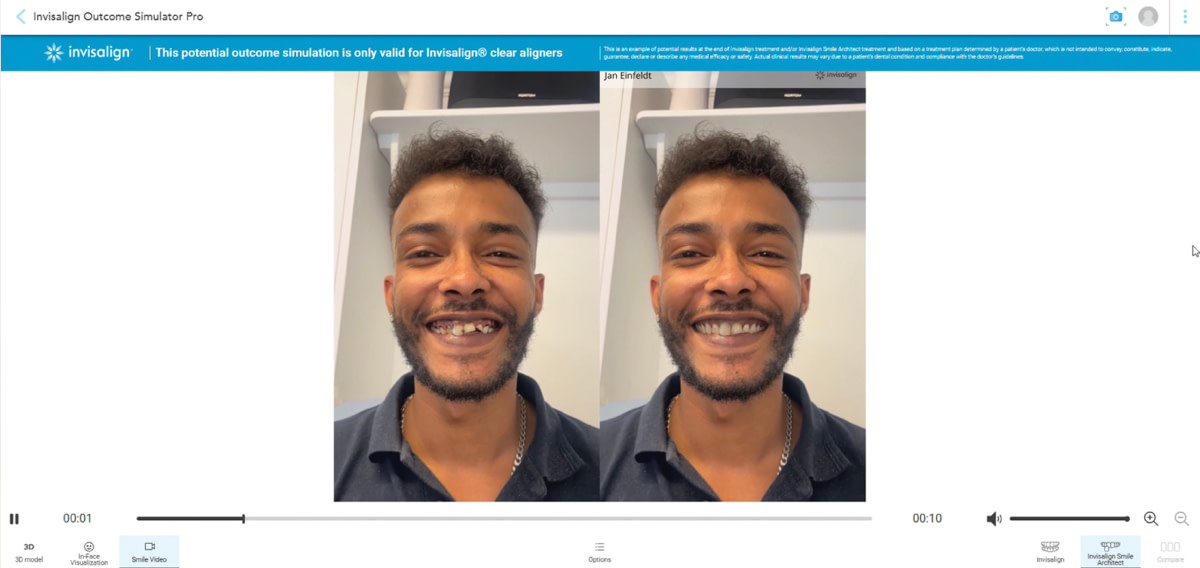

Invisalign Smile Video - An impressive solution that is designed to drive treatment acceptance through emotional engagement. The Invisalign Smile Video uses AI to create video-based outcome simulations.

This builds on their previous static simulation approach, incorporating dynamic video presentations specifically targeting chairside conversions for both Invisalign and ortho-restorative treatments, making this the only solution on the market currently that shows video-based future smile outcomes within an IOS software.

Advanced Personalization - As clinicians seek to standardize their workflow to optimize chairside conversion to treatment planning, this simulator now supports personalized treatment parameters, including IPR (interproximal reduction), A/P correction, and, notably, the Preferences Template, which is part of IPP Invisalign Personalized Plan for orthodontic or ortho-restorative cases. Giving clinicians more control over the simulation, allowing them to match their intended treatment approach rather than showing generic outcomes.

Expanded Product Selection - The simulator now includes Invisalign Lite, Express, and Moderate options within the visualization workflow. This addresses a business challenge - getting started with Invisalign by treating mild malocclusions and managing patient expectations.

Strategic Implications

What's notable about Align's approach is the breadth and depth of ecosystem integration they are building. They're systematically integrating scanning hardware with patient conversion tools (Outcome Simulator), dental examination tools (Oral Health Suite), and restoration workflows (Design Suite), while maintaining third-party compatibility through the iTero-exocad Connector, as their proprietary CAD solution develops in parallel.

The commercial logic is straightforward: embed the iTero scanner at every clinical touchpoint. The 2025 releases demonstrate platform maturation across patient communication, treatment visualization, and open connectivity, creating a more comprehensive software environment around the scanning hardware.

The value equation varies by practice type, in my opinion. For Invisalign-focused practices, this integrated ecosystem delivers clear workflow advantages and conversion tools specifically designed for aligner treatment. For general restorative practices, with the addition of new Lumina restorative capabilities, the assessment will be determined by general practitioners who see value in the adoption and utilization of these solutions. The Gumlines feature signals an important strategic shift. Align is expanding beyond its orthodontic foundation into comprehensive oral health assessment. This isn't just feature development, it's a necessary response to competitive pressure from scanner manufacturers who've built their platforms around general dentistry from the start.

The question is - does Align's integration offer meaningful benefits over competitors that may bundle comparable features under different pricing structures?